TurboTax Canadian Personal Tax Software

Can a person who handles their own finances do their own taxes with TurboTax Online? As far as I’m concerned, that’s the key question. And based on my experience with TurboTax Online, the answer is yes.

When the people at intuit asked me to write a review of TurboTax Online, I was interested. I have used the desktop version of TurboTax (and its predecessor) for years, but I hadn’t taken it online.

Privacy

A big concern of mine is privacy. As I started the package, I received a warning that my information could end up on a server outside of Canada. That concerned me because I don’t want my tax information to be used to profile me. However, I found this paragraph in intuit’s Privacy Statement:

Intuit is a multi-national company and as such, some personal information may be shared within Intuit and stored in countries outside of Canada. Currently, some personal information, excluding tax return information, may be stored or processed in the United States and therefore may be subject to US legislation. Tax return information remains in Canada unless you give Intuit your express consent for it to be transferred and/or stored outside of Canada. ‘Tax return information’ excludes non-personally identifiable information concerning your use of the Intuit tax products — e.g. which screens you viewed. [my emphasis]

OK, on that basis, I was prepared to move ahead. But wait, how long is my information available to me? Here’s the answer:

The TurboTax Online Services for Tax Year 2013 are not accessible after November 30, 2015 and shall not be supported beyond that date.

Of course, you can download your full tax return(s) as pdf files, so you can save the information as long as you like. You just can’t go back into the system and change your return after the cut-off date.

Review

Here are my experiences using the software for my own return.

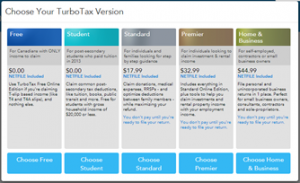

First of all, there is a good selection of packages, from the simple, free one (great for tax clinics) up to Home & Business for the entrepreneur. That is the version I selected.

Personal information – The package picked up my personal information from last year’s file, even though last year I used the desktop version.

I found the interview questions to be detailed and easy to understand. It’s helpful knowing that you can go back and change any of the answers at any time.

As an accountant, I don’t usually use the interview feature. I just put together my pile of tax forms and enter them directly. In the online system, you can do that too. I just selected the form from the drop down menu and away I went.

Look and Feel

intuit has done their best to make tax software simple. There are only 5 steps in the interview process. The screens have large fonts and lots of white space. The descriptions are readable and as easy to understand as possible given that we’re talking about income tax.

How to Use TurboTax Online

In the old days, you had to accumulate all of your tax forms and then sit down and do your taxes, because you didn’t want to have to come back later and erase half the return because you needed to add something to the first page. The beauty of TurboTax is that you can add any form at any time. In fact, if you take a few minutes and update your return as the T4’s and the charitable receipts arrive, you’ll be almost done when you sit down to do your taxes!

An important advantage of doing your taxes this way is that TurboTax’s questions will remind you of forms you need to get. They don’t all arrive in the mail any more. For example, the universities ask their students to download their tax forms from the university web site.

There’s no need to wait for April to start your TurboTax 2013 return! You can start your return for free. You only pay when you actually produce the return for filing. And if after all of the prompts you are still nervous, you can get a professional accountant to review it. But I think you will find that the review built into the system is pretty thorough.

A great informative post you shared on this page about calculating the tax returns of a successful business easily by using online system software , I read this post and remember the best points especially ” customer service management ” mentioned in this article which help me for running a business successfully with the help of professional accounting .If you want to start a business successfully then you must read this article carefully and keep it in your mind all the best points of a great article which help you to running a business successfully with the professional accountant .

Thanks